Weekly Wealth Wire

Weekly Wealth Wire

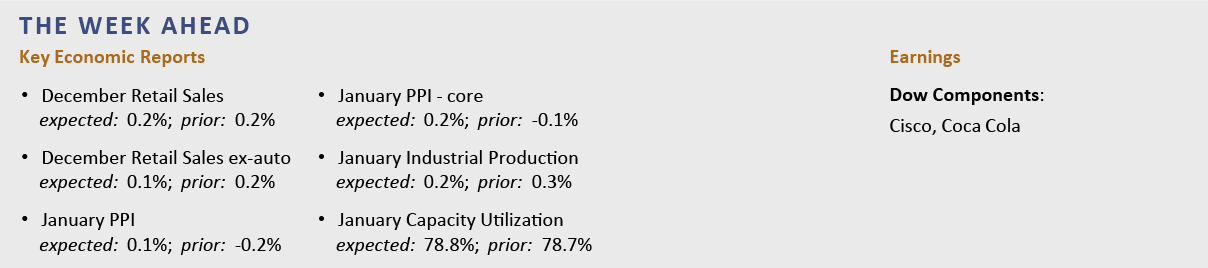

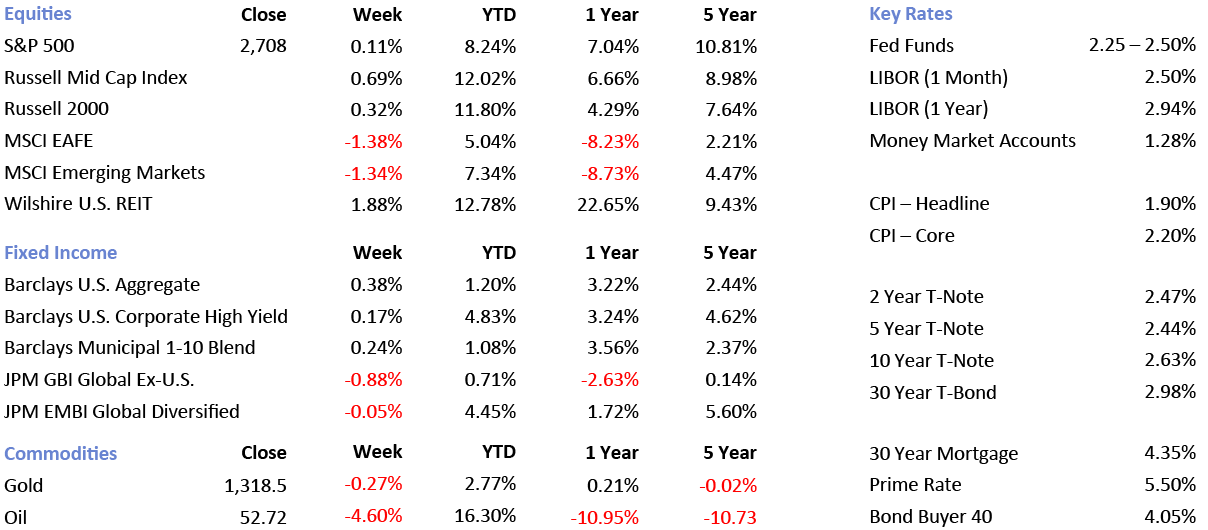

February 11, 2019 — U.S. government bond prices rose last week, while the S&P 500 Index returned 11 basis points for the first full week in February. Strong demand and positive earnings news, offset by weak economic data our of Europe, were the main market drivers.

In economic news, U.S. initial jobless claims of 234k were higher than the consensus estimate of 221k, but lower than the previous week's 253k. The January reading of the ISM non-manufacturing index missed expectations as the government shutdown weighed on sentiment but still signaled expansion, declining from 58.0 in December to 56.7. Crude oil prices closed the week at $52.72 per barrel, decreasing 4.60% for the week. In Europe, German manufacturing orders and industrial production both fell unexpectedly in December and the European Union cut its forecast for economic growth in the area from 1.9% in 2019 to 1.3%, pushing U.S. government bond prices higher.

Meanwhile, fears lingered that the U.S. and China will not reach a trade deal ahead of a March 1 deadline for White House economic adviser Larry Kudlow said a deal was a "pretty sizable distance" away. Following the March 1 deadline, suspensions on certain tariff increases will be lifted. At the end of last week, Fed funds futures implied nearly a nearly 0% chance that the Fed will raise rates in 2019, down from about 30% only two weeks prior.

In earnings news, Alexion Pharmaceuticals, Clorox, Seagate Technology, Mattel, Coty Inc., and Alphabet Inc. all beat earnings estimates, however Anadarko Petroleum, an oil and gas exploration company, released disappointing earnings and was the week's worst performer in the S&P 500. Next week will bring more earnings news from companies such as Cisco Systems, Coca-Cola, PepsiCo, NVIDIA Corp, CME Group, and many more.

Vital Signs

Sources: briefing.com, Yahoo Finance, Kitco.com, U.S. EIA, First Trust, Wintrust Wealth Management analysis. Returns are total returns calculated through 2/8/2019 and 5 year returns are annualized. Gold is the New York spot price in $/oz. Oil is the Cushing, OK WTI spot price FOB in $/BBL. Securities, insurance products, financial planning, and investment management services are offered through Wintrust Investments, LLC (Member FINRA/SIPC), founded in 1931. Trust and asset management services offered by The Chicago Trust Company, N.A. and Great Lakes Advisors, LLC, respectively. ©2019 Wintrust Wealth Management

Investment products such as stocks, bonds, and mutual funds are:

NOT FDIC INSURED | NOT BANK GUARANTEED | MAY LOSE VALUE | NOT A DEPOSIT | NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY